Credit Card Stacking

Unlock up to $500K in Business Funding with 0% Interest, No Income Verification, and No Time in Business Required!

Credit Card Stacking at A Glance

What to Expect

Lines of Credit

Up to $500,000+

Repayment terms

Revolving

Payment Options

Monthly

Available through

PCG & Our Finanacing Network

Key Features of Credit Card Stacking

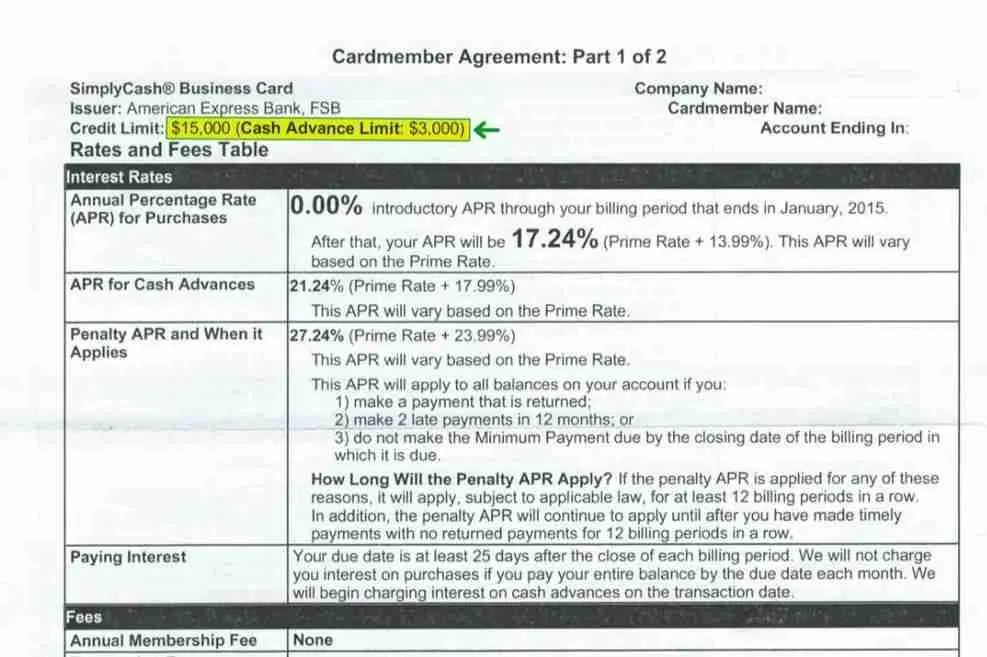

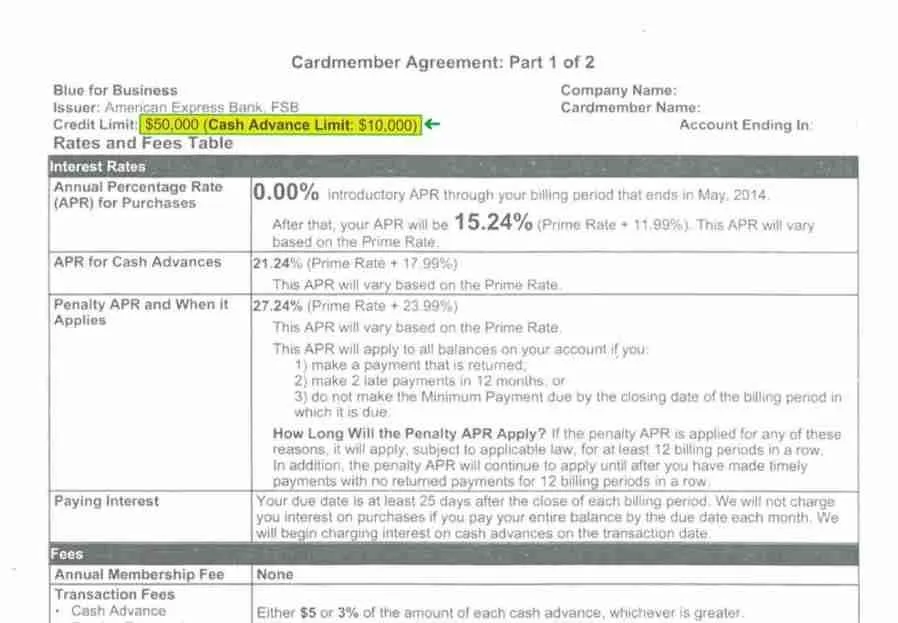

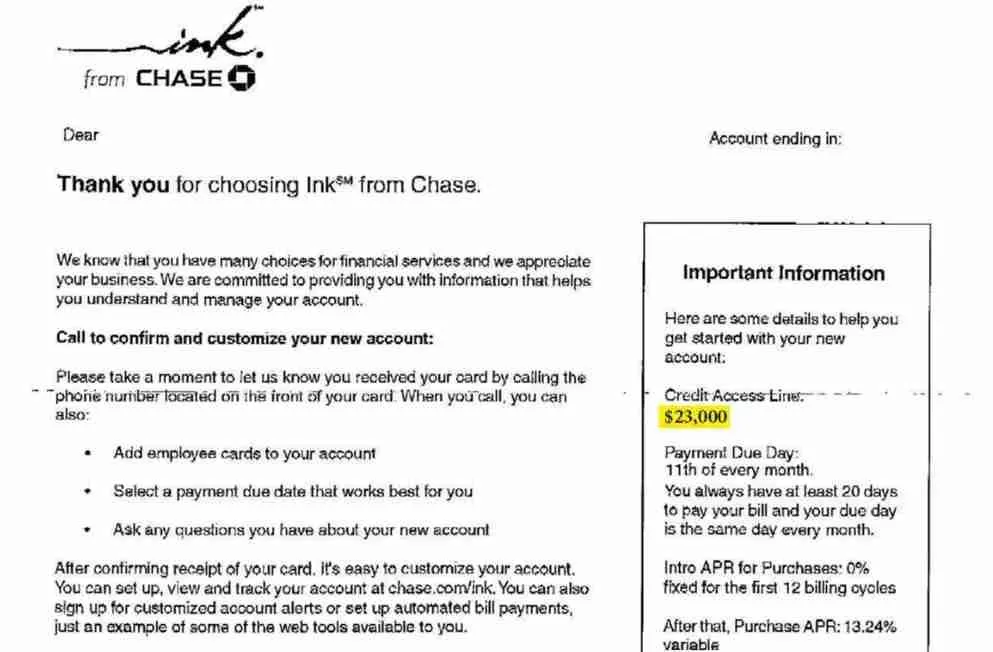

1. 0% Interest Offers: Many credit cards offer an introductory 0% APR for a set period, often 6–18 months. This allows businesses to borrow without paying interest during that time.

2. Unsecured Credit: Unlike traditional loans, credit card stacking doesn’t require collateral, making it an attractive option for startups or businesses without significant assets.

3. Creditworthiness-Based: Approval for multiple credit cards depends heavily on the applicant’s personal or business credit profile.

4. Flexible Use: Funds can be used for various purposes, such as inventory, marketing, or startup costs.

Pros

Quick access to funds.

No immediate interest payments if managed well.

No collateral is required.

Builds Business credit.

Continuous access to credit.

Only pay on amounts you use.

No Income Verificaiton

No Time in Business Requirement.

Cons

Mismanagement can lead to high-interest debt after the introductory period.

Requires strong credit to qualify for multiple cards

Credit Card Stacking Process with Pennington Consulting Group

Quick and Easy Application Process

Applying for Credit Card Stacking is simple! Just provide a recent copy of your credit report, and we’ll assess your eligibility.

Have Your File Evaluated

Once we receive your credit report, our proprietary system will evaluate it and provide your qualification results within a few hours or by the end of the day.

Lines of Credit

Our “Done For You” Credit Stacking Program creates a tailored strategy based on your credit profile, selecting the best lenders and application sequence to maximize your approvals.

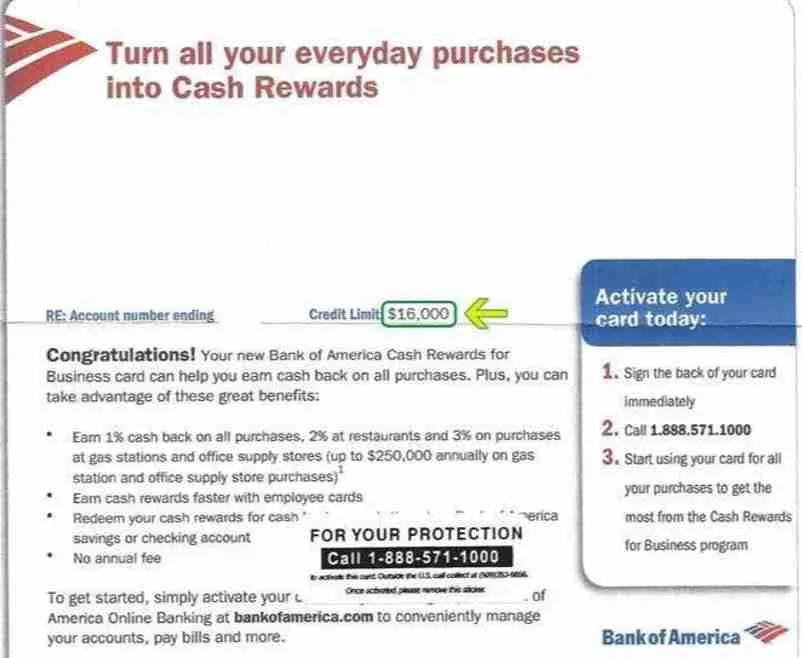

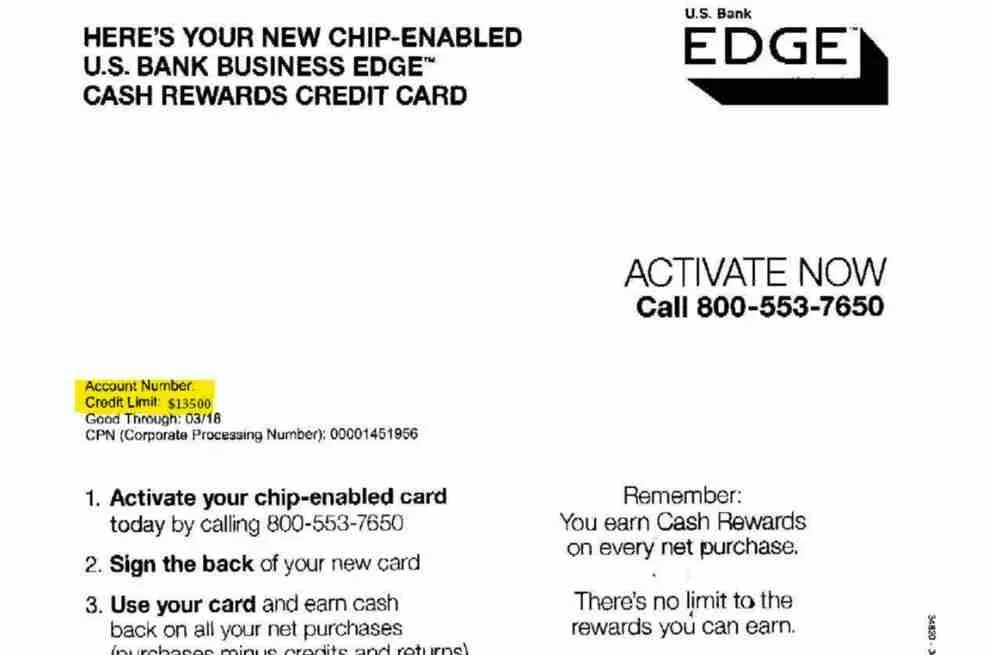

Qualifying for a Pennington Credit Card Stacking

At Pennington Consulting Group we specialize in Credit card Stacking we have been doing this for over a decade. With our quick pre approval process all we need is a recent copy of your credit report to get you pre approved. With our Proprietary formula we will come up with a customized plan for your specific credit profile to maximize on approvals better than anyone in the industry. We have a full “Done for you” process where we will evaluate your file, prepare your file for processing and choose the correct flow on how to submit the applications to increase your funding amount and access to credit.

Time in Business

No Time in Business

Annual Revenue

None

Credit Score

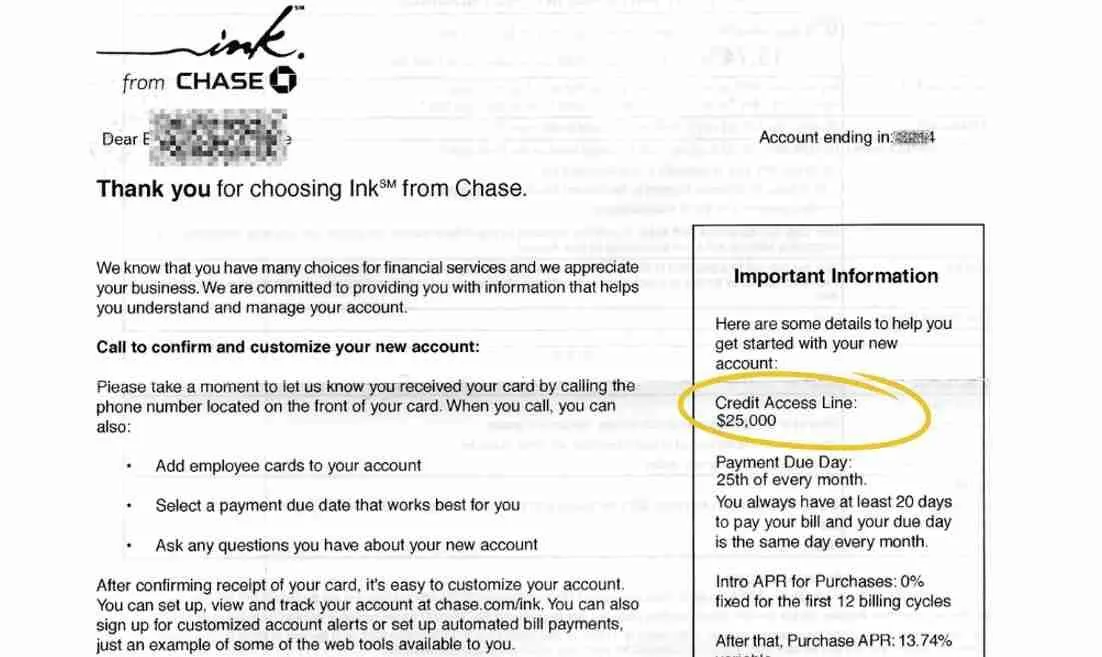

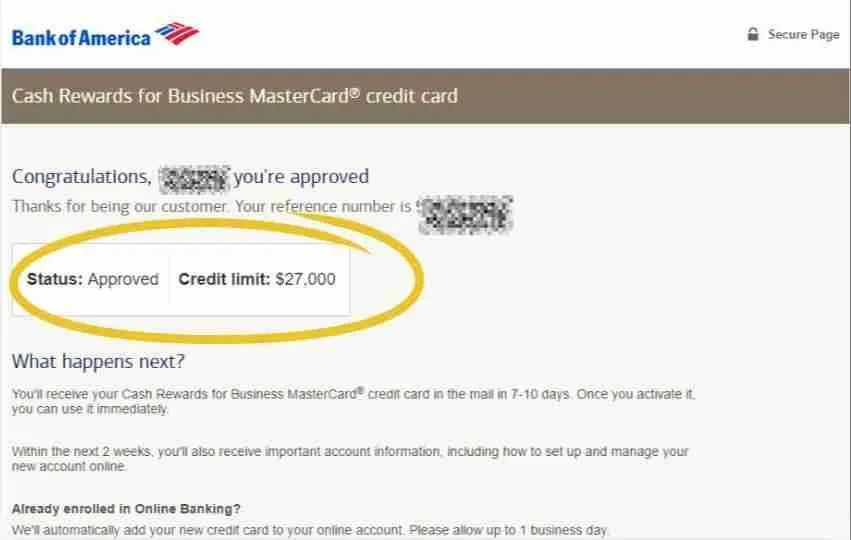

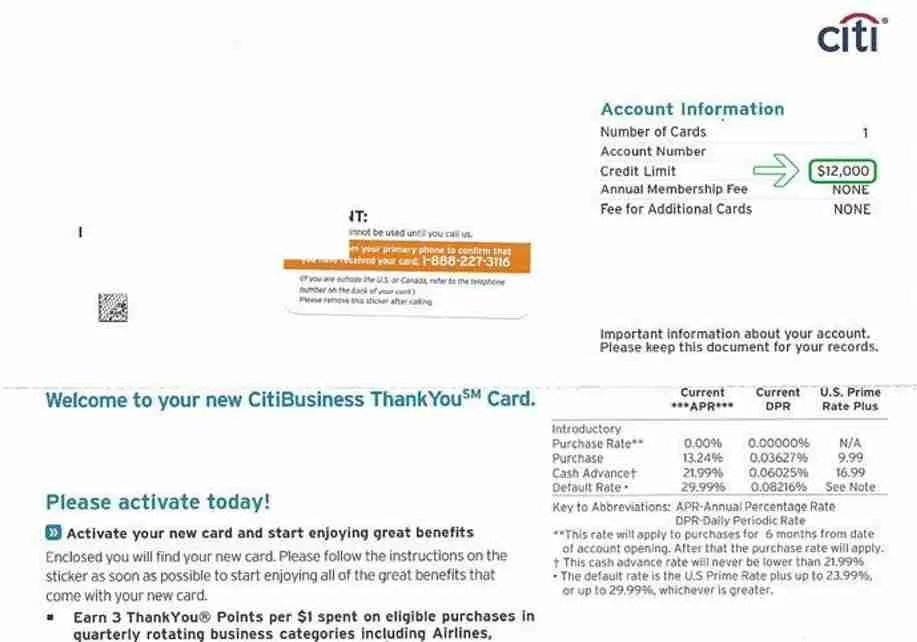

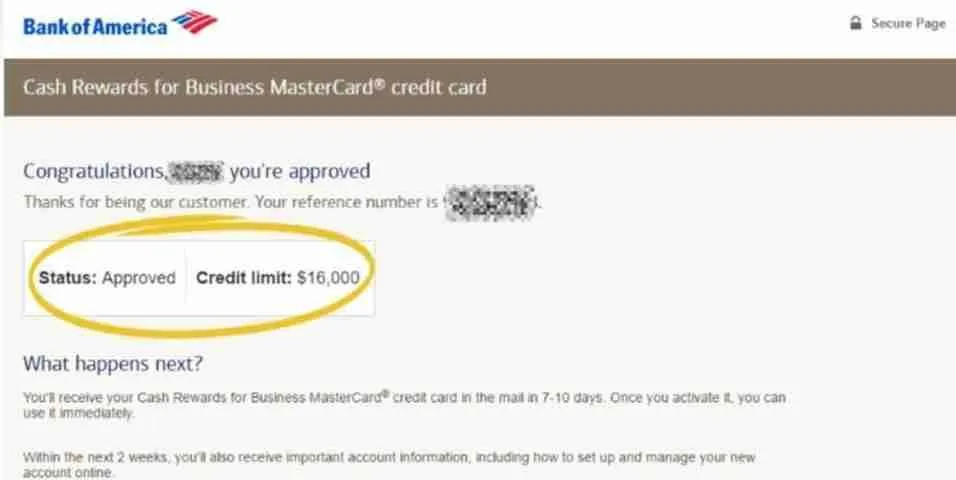

Approvals We've Secured

Ready to Get Started?

Connect with a Pennington Business Financing Specialist to find out more

Discover Additional Financing Opportunities

Equipment Financing

It's your fast pass to getting the gear you need without draining your cash flow. It’s a loan specifically for buying or leasing equipment, using the gear itself as collateral. Think of it as turning tomorrow’s profits into today’s productivity boost!

Purchase Order Financing

Get a financial jumpstart to fulfill big orders. A lender fronts the cash to cover supplier costs, so you can deliver without draining your pockets. Think of it as your secret weapon to say “yes” to that massive order, even if your bank account says “not yet!”

SBA Loans

Starting or growing your business? An SBA loan could be your golden ticket, offering lower down payments and super flexible terms. At Pennington Consulting Group, we’ve got the full package to cover all your business lending needs. With over $50 million in SBA funding secured, we’re the experts who make the SBA process smooth and get you the funding you need—no sweat!

Need Assistance?

Quick Link

Services

Contact

Copyright 2025. All rights reserved.