Real Estate Loans

Provide funding to buy, refinance, or develop property. These loans offer options like fixed or variable interest rates, and are available for residential or commercial properties.

Real Estate Loans at A Glance

What to Expect

Lines of Credit

From $150,000 - $50M+

Repayment terms

6 to 360months

Payment Options

Principal Interest and Interest Only Options Available

Available through

PCG & Our Finanacing Network

Real Estate Loans with Pennington

At Pennington Consulting Group , we specialize in providing innovative funding solutions for real estate investors, developers, and entrepreneurs. Whether you’re acquiring your first property, refinancing an existing portfolio, or developing a large-scale commercial project, we have the expertise and resources to make it happen.

Our programs include:

Fix & Flip Loans: Fast funding to help you purchase, renovate, and sell properties for profit.

Rental Property Financing: Long-term solutions for buy-and-hold investors seeking stable cash flow.

New Construction Loans: Flexible funding for residential or commercial developments.

Bridge Loans: Short-term financing to bridge the gap between transactions or other financing.

With competitive rates, flexible terms, and a commitment to personalized service, we’re here to empower your real estate journey. Let us turn your vision into reality—one property at a time.

Ready to explore your options?

Fix & Flip Loans

Transform your vision into value with our Fix & Flip Loans. Whether you’re an experienced house flipper or just getting started, we provide fast, hassle-free funding to help you purchase properties, complete renovations, and sell for maximum profit.

Quick Approvals: Get funding in as little as 7–10 days to seize the best opportunities.

Tailored Loan Amounts: Cover up to 90% of purchase and 100% of renovation costs.

Flexible Terms: Short-term loans designed to fit your project timeline.

Your next successful flip is just a loan away—let us help you build your real estate empire!

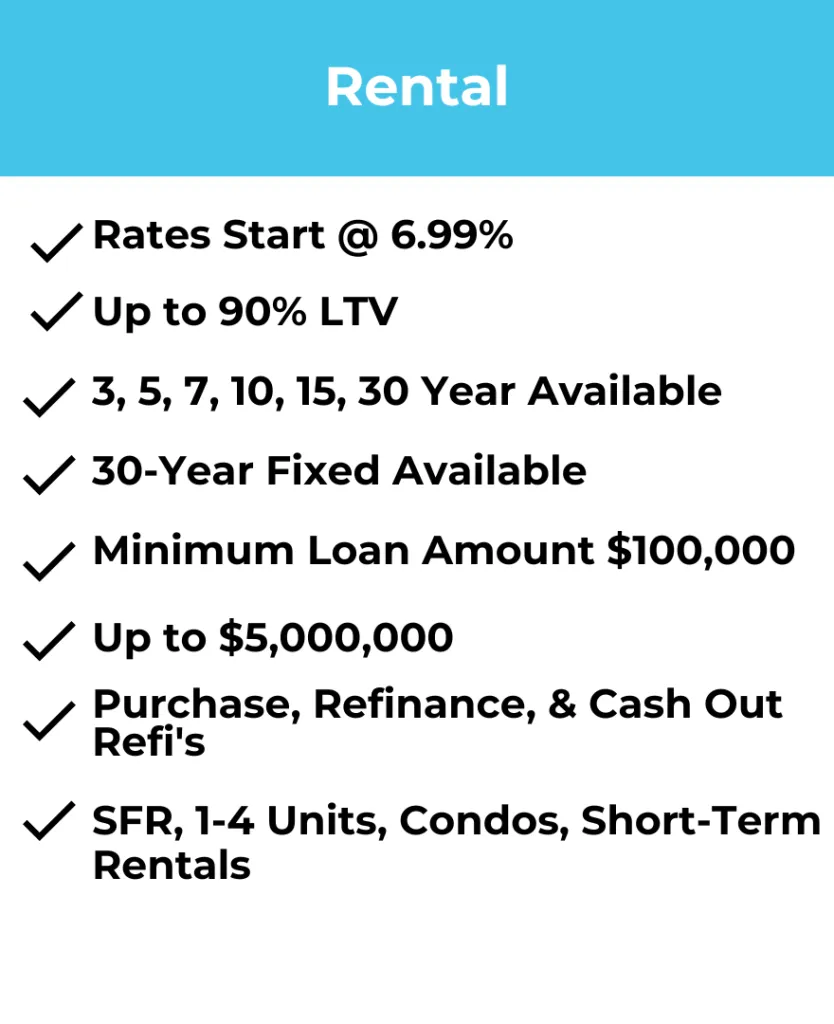

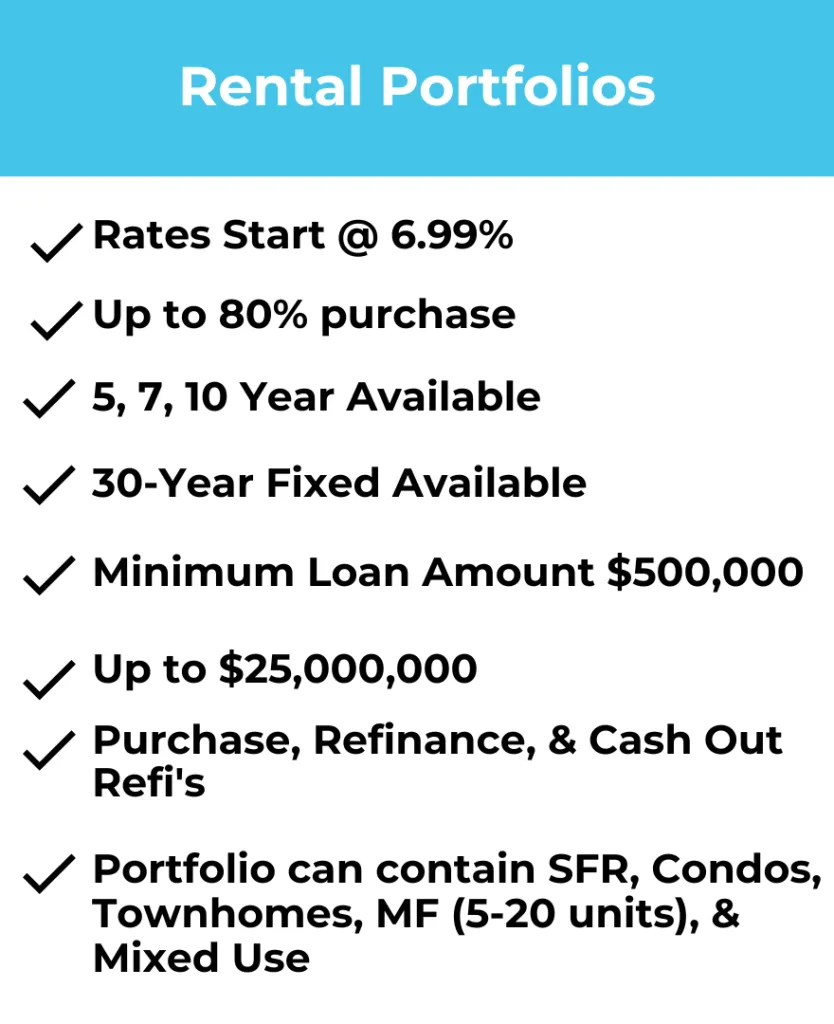

Rental Property Financing

Build long-term wealth with financing designed for buy-and-hold investors. Whether you’re growing your portfolio or refinancing an existing property, we offer competitive solutions tailored to your investment goals.

Low Rates: Enjoy stable, long-term financing options with competitive interest rates.

No Tax Returns Required: Flexible underwriting for investors with alternative income documentation.

Portfolio-Friendly: Financing options available for single properties or portfolios.

Let us help you secure steady cash flow and grow your passive income potential!

New Construction Loans

Take your vision from blueprint to reality with our New Construction Loans. From ground-up residential developments to large-scale commercial projects, we’re here to provide the funding you need.

Customizable Loan Options: Designed to meet the unique demands of your project.

Fast Draws: Access funds quickly as construction milestones are reached.

Expert Support: Partner with a team that understands the construction process.

Turn your ideas into iconic spaces with our flexible construction financing solutions.

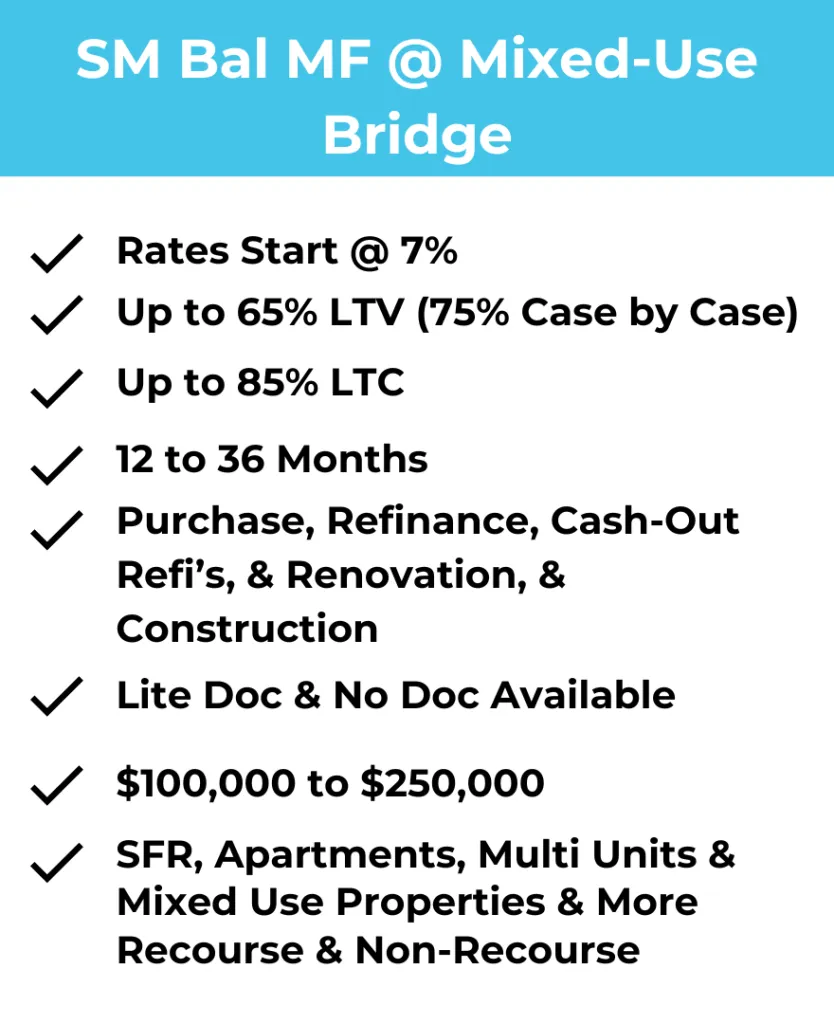

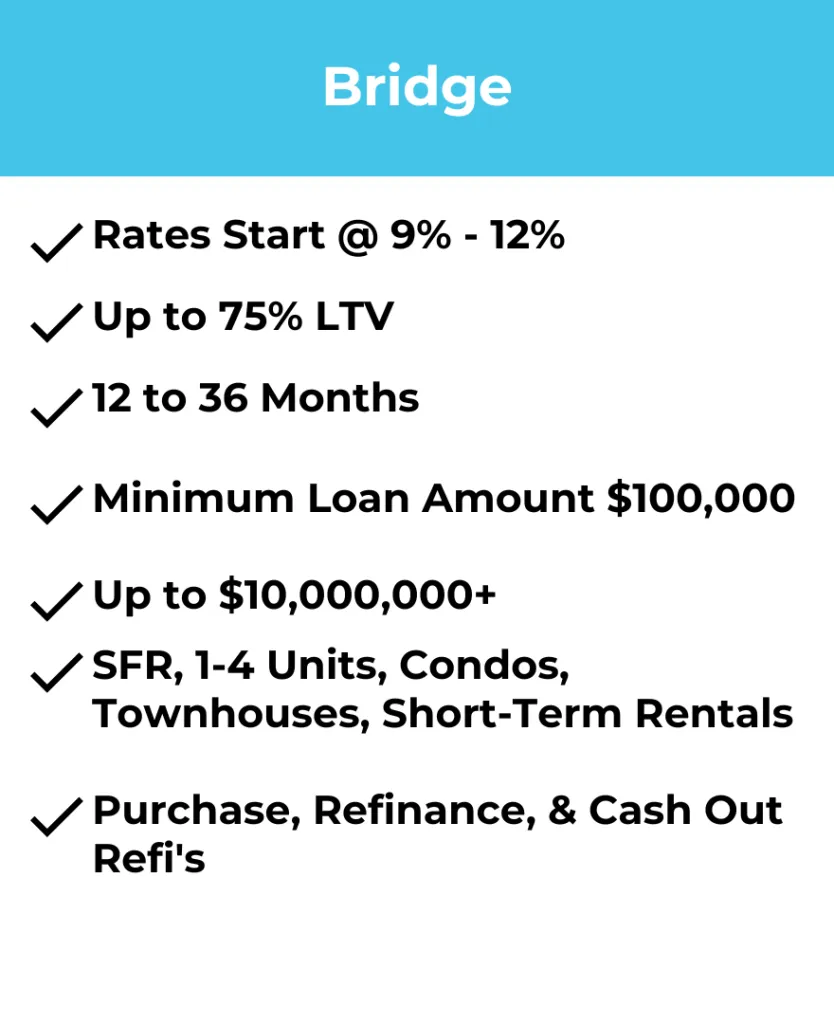

Bridge Loans

When timing is everything, Bridge Loans provide the quick funding you need to close deals or manage cash flow. Perfect for real estate transactions requiring short-term financing.

Rapid Approvals: Close deals fast and stay competitive in the market.

Flexible Use: Cover gaps between buying and selling, refinancing, or other funding.

Tailored Terms: Borrow only what you need with terms that match your goals.

Bridge the gap and keep your projects moving forward with confidence.

Our Programs

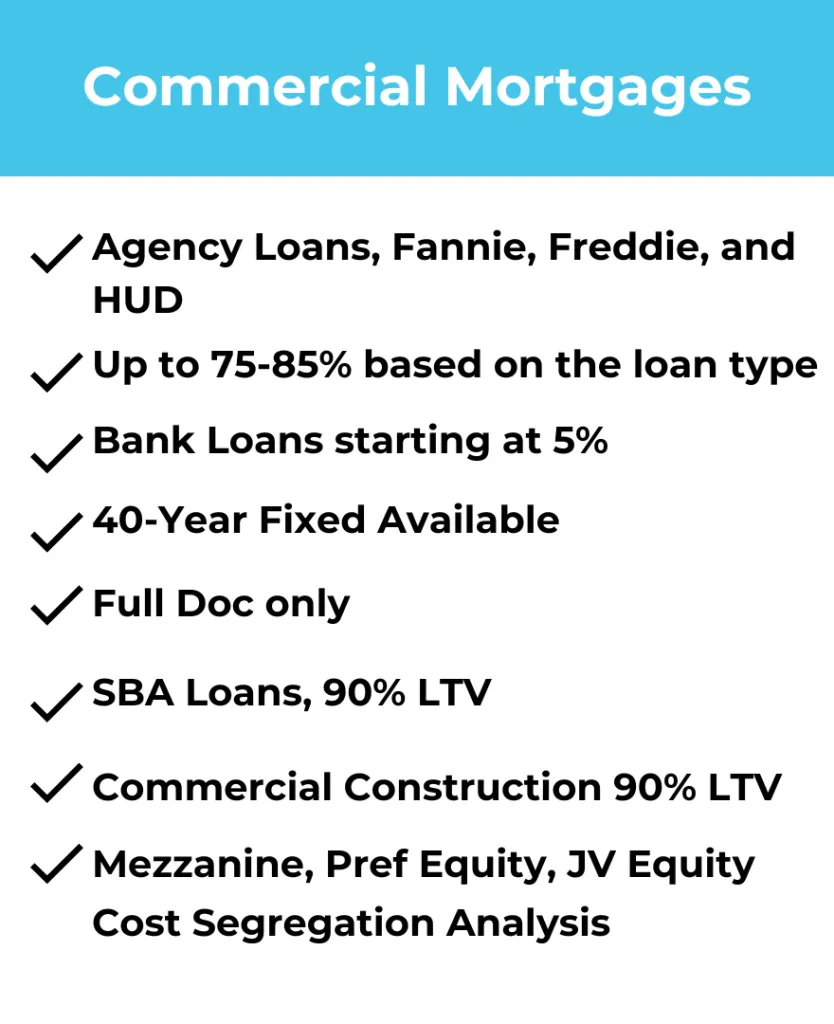

Commercial Real Estate Loans

Residential Real Estate Loans

Real Estate Program Benefits

Quick and Easy Application Process

At Pennington Consulting Group, we value your time, so our application process is simple and designed specifically for Real Estate Investors who need quick access to capital.

Our easy-to-navigate application and minimal paperwork requirements allow you to quickly get an answer and a pre-approval.

Compare Multiple Offers at Once

Pennington Consulting Group simplifies your financing choices.

By submitting just one application, you gain access to a variety of financing offers, giving you the freedom to compare options and choose the solution that best suits you and your business.

Top-Notch Team

At Pennington, our team is committed to finding investors and developers. Our dedication to excellence in over a decade in the industry has earned us an A+ rating with the Better Business Bureau.

Pre-Qualify Today

We understand that every real estate project is unique, and so are your funding needs. Whether you’re a seasoned investor or just starting your journey, we offer tailored financing solutions to help you achieve your real estate goals. Lets schedule a call today to discuss your funding scenario.

Discover Additional Financing Opportunities

SBA Loans

Starting or growing your business? An SBA loan could be your golden ticket, offering lower down payments and super flexible terms. At Pennington Consulting Group, we’ve got the full package to cover all your business lending needs. With over $50 million in SBA funding secured, we’re the experts who make the SBA process smooth and get you the funding you need—no sweat!

Purchase Order Financing

Get a financial jumpstart to fulfill big orders. A lender fronts the cash to cover supplier costs, so you can deliver without draining your pockets. Think of it as your secret weapon to say “yes” to that massive order, even if your bank account says “not yet!”

Equipment Financing

It's your fast pass to getting the gear you need without draining your cash flow. It’s a loan specifically for buying or leasing equipment, using the gear itself as collateral. Think of it as turning tomorrow’s profits into today’s productivity boost!

Ready to Get Started?

Connect with a Pennington Business Financing Specialist to find out more

Need Assistance?

Quick Link

Services

Contact

Copyright 2025. All rights reserved.